If you want to join the discord for intra-day commentary, you can do so here. Discord members get free substack access. There is also a free version of the discord here.

DISCLAIMER:

This newsletter is purely for educational/entertainment purposes and does not in any way constitute financial advice. The author is not a financial advisor and does not provide financial advice in any capacity. Any actions taken by the reader on the basis of the topics discussed herein is the sole responsibility of the reader.

This newsletter is copyrighted and is the property of Ghost Capital, LLC. It is not to be reproduced or distributed without the express consent of the author(s). Violation of this clause is punishable under the laws of the great state of Texas, and you are welcome to meet my lawyer should you violate this clause. He’s a really nice guy.

HOUSEKEEPING:

If you have specific tickers that you are interested in, let me know what they are and what time frame you are looking at. I’m happy to do some TA and post my thoughts. If things are otherwise unclear within the letter, feel free to message me.

The permanent educational materials (like the core setup post) will come together over time. I will prioritise them based on feedback from readers. So let me know!

INTRODUCTION:

This is a level heavy day recap. This is the value of the majors, and I’m emphasising it here.

Last week was characterised by one thing - volatility. Huge 120 point intraday swings.

This week seems to be getting back to more normal. Yesterday’s action should have been no surprise as we break out of a ~140 point balance from last week. PPI coming in soft only exacerbated this problem for shorts.

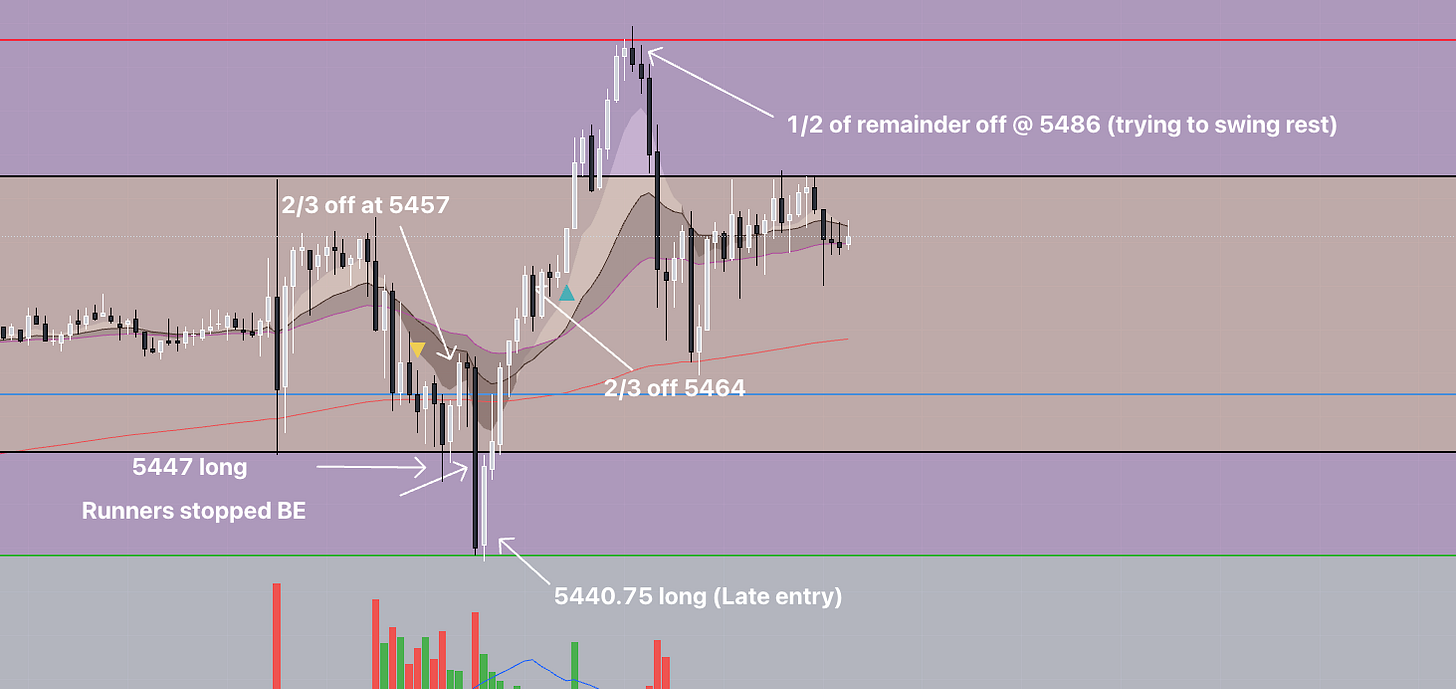

Structurally, we had a small box from yesterday which we broke out of firmly on PPI. This got us all the way back into our previous 4H box > 5439. Off the cash open, we tested 5439 which held firmly. After a resultant squeeze out to 5486 next big target, we dipped and consolidated through mid day.

I took two trades again today. The initial fail to break below the box, with runners stopped at BE. Then another for the test of the bottom of the 4H box. I wanted to play a failed breakdown of this level, but only got to 1/3 size (no swipe below) which is why I systematically enter these trades at big levels. Runners are still alive for this one, SL currently 5454.

Now that we are post-weekly mean reversion, buyers continue to eat it up. The vol crush continued with FORCE today. $VIX closed the day down ~10% at 16.21.

On the Macro side, CPI YOY actual 2.9% vs 3% est. MOM was 0.2%, in line. Core CPI MOM was also in line at 0.2%, and Core YOY was in line at 3.2%. Fed Rate cut bets were slightly pared back after this print. Now sitting at ~55% chance of 25 bps September cut and ~45% of a 50bps cut. Continuing with macro, TLT 0.00%↑ completed its backtest of the 94.82 level, bouncing with precision. It continued its uptrend today. Random levels, eh? We will discuss the future of this trade below.

$ES_F is now ~360 points off the lows of last week. Do we buy every dip? Expect commentary on that and more in today’s newsletter.

Keep reading with a 7-day free trial

Subscribe to Ghost Capital Newsletter to keep reading this post and get 7 days of free access to the full post archives.